A severe Texas storm just rolled through your neighborhood, and the sound of hail on your roof was unmistakable. In the aftermath, you might be looking at your home wondering, “What now?” Dealing with potential storm damage is stressful enough, but navigating the insurance claim process can feel downright overwhelming.

As a trusted DFW roofing contractor, we’ve helped countless homeowners through this exact situation. The process is manageable when you break it down into clear, actionable steps. This guide will walk you through how to file a roof insurance claim in Texas, from the moment the storm passes until your roof is fully restored.

The First Steps: Safety and Immediate Assessment

Before you do anything else, prioritize safety. After a major storm, walk around your property to check for downed power lines, fallen tree limbs, and other immediate hazards. Once the area is safe, you can begin the initial damage assessment.

Step 1: Document Everything Immediately

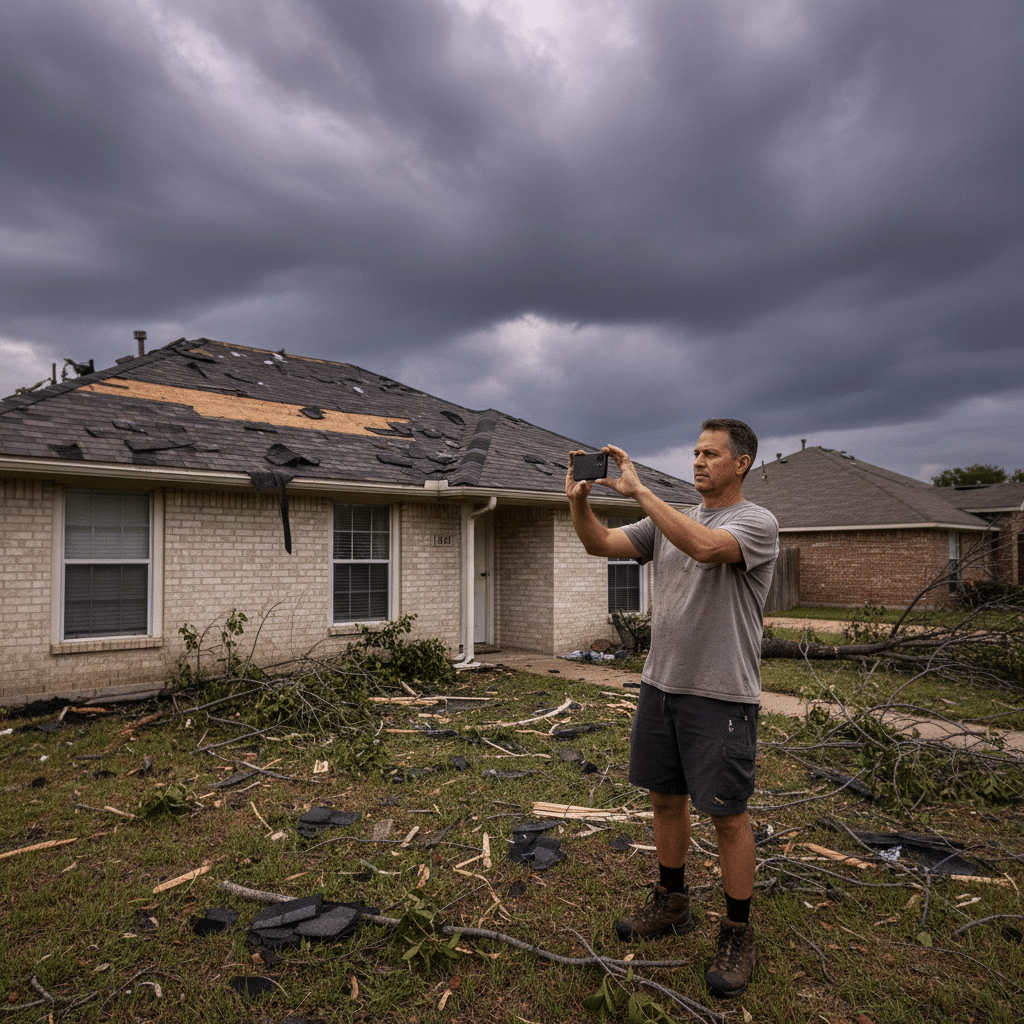

Your smartphone is your most powerful tool at this stage. Before you touch or move anything, thoroughly document the damage to your property. Strong documentation is the foundation of a successful roof insurance claim in DFW.

What to photograph and video:

- The Ground Level: Take pictures of any shingles, metal flashing, or other roofing debris that has been blown into your yard.

- Hail Damage: Photograph dents on your gutters, downspouts, air conditioning unit, and window screens. This helps establish the size and intensity of the hail that hit your property.

- Your Roof (Safely): If you can do so safely from the ground or a second-story window, take broad shots of your roof to show any obvious missing shingles or large areas of damage. Do not get on your roof. It could be dangerously slippery or structurally compromised.

- Interior Damage: Check your attic and ceilings for any water stains or active leaks. Document these immediately.

Keep a written log with the date and time of the storm. This initial evidence is crucial for your insurance company.

Step 2: Take Temporary Measures to Prevent Further Damage

Your insurance policy requires you to take reasonable steps to mitigate further damage after a loss. This means preventing a small problem from becoming a catastrophic one.

For example, if a tree limb has punctured your roof or you have a severe, active leak, you may need to place a tarp over the damaged area. This is a temporary fix to keep water out until a professional can assess the situation. Be sure to take photos of the initial damage before you cover it. Most professional roofers can assist with this emergency tarping.

Working with Professionals: Your Contractor and Your Insurer

Once you’ve documented the damage, it’s time to bring in the experts. The order in which you contact them is important.

Step 3: Call a Reputable DFW Roofing Contractor

Before you call your insurance company, have a trusted, local storm damage roof repair expert perform a thorough inspection. This step is critical for several reasons:

- Professional Assessment: A qualified roofer can identify damage that is invisible from the ground, such as hail “bruises” that have compromised the shingle’s integrity but haven’t yet caused a leak.

- Damage Verification: They can confirm whether the damage is significant enough to warrant a claim. Sometimes, the repair cost might be less than your deductible, in which case filing a claim would not be beneficial.

- Expert Documentation: The contractor will provide their own detailed report and photo evidence, which adds significant weight to your claim.

This professional inspection gives you a clear understanding of the scope of work before you even start the claims process.

Step 4: Review Your Policy and Contact Your Insurance Company

Find your homeowner’s insurance policy and review the section on roof coverage and your deductible. Your deductible is the amount you are responsible for paying before your insurance coverage kicks in.

With your contractor’s inspection report in hand, contact your insurance provider’s claims department to formally initiate the claim. Provide them with your policy number, the date of the storm, and a general description of the damage. They will assign you a claim number and an insurance adjuster.

The Inspection and Adjustment Process

This is where your claim is either approved or denied. Having a professional roofer on your side during this phase is your best strategic advantage.

Step 5: Schedule the Adjuster’s Inspection and Have Your Contractor Present

The insurance adjuster will schedule a time to visit your property and conduct their own inspection. It is highly recommended that you have your chosen roofing contractor present for this meeting.

Why this is important:

- Advocacy: Your contractor acts as your advocate, ensuring the adjuster doesn’t miss or underestimate any of the storm damage. They speak the same language and can point out specific issues that require attention.

- Accurate Scoping: The roofer and adjuster can review the damage together, often agreeing on the scope of repairs or replacement on the spot. This can prevent lengthy back-and-forth disputes later on.

- Fair Assessment: It ensures the adjuster’s assessment is fair and comprehensive, covering all necessary components for a proper roof restoration according to local building codes.

Step 6: Understand the Adjuster’s Report and Initial Payment

After the inspection, the adjuster will create a report detailing the covered damages and the estimated cost of repair. This is often called a “scope of loss.” You will typically receive an initial check for the “Actual Cash Value” (ACV) of the damages.

ACV is the value of your damaged roof minus depreciation. Your policy will likely include “Replacement Cost Value” (RCV) coverage. This means you will receive the remaining funds—the “depreciation”—once the work is completed and you submit a final invoice from your contractor. Your roofer can help you decipher this paperwork to ensure everything is in order.

Completing the Work and Finalizing the Claim

With an approved claim, you are now ready to restore your roof.

Step 7: Sign a Contract and Schedule the Work

Sign a contract with your chosen DFW roofing contractor. The contract should clearly outline the scope of work agreed upon with the insurer, the materials to be used, and the total cost. Once signed, the contractor will schedule your roof replacement or repair.

Step 8: Final Invoice and Final Payment

After your new roof is installed, the contractor will provide you with a final invoice. You will submit this invoice to your insurance company. They will then release the final payment (the recoverable depreciation). You use this, along with your first check and your deductible payment, to pay your contractor in full.

Filing roof claims in Texas doesn’t have to be a complicated battle. By following these steps—documenting thoroughly, hiring a trusted contractor first, and having them advocate for you—you can navigate the process smoothly and ensure your home is protected for years to come.

If your home has been hit by a recent storm, don’t wait for a small leak to become a huge problem. Contact us today for a free, no-obligation inspection.